Gov. Ricketts' $147 Million in Property Tax Relief

Get the Facts on Responsible Tax Reform (LB461)

- Tax Relief for All Nebraskans: Nebraskans of all income levels will see tax relief on their income under this plan. Middle and low-income Nebraskans will see the biggest percentage reduction in income taxes.

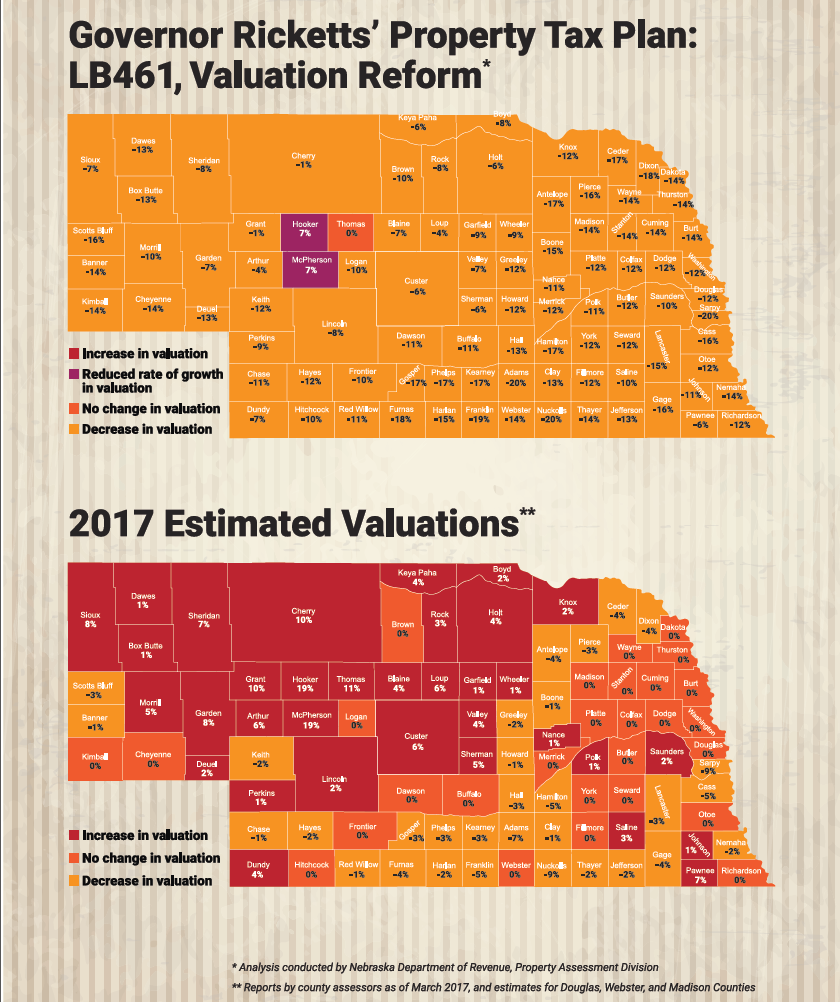

- Property Tax Reform First: The plan changes the way ag land is valued for taxation purposes beginning in 2018, moving from a comparable market sales approach to valuing land based on its income potential. Functionally, this plan would have reduced ag land property valuations by $12 billion if it had been in place in 2017. This would have been an average reduction of 12 percent statewide. With flat levies, this would have reduced property tax on ag land by about $147 million in 2017. This plan also protects our K-12 schools with a projected investment of over $30 million each year in the state aid formula.

- Incremental Income Tax Relief: Starting in 2020, reduces the top income tax rate incrementally from 6.84 percent to 5.99 percent, but only if state revenues are expected to grow by 3.5 percent or more.

- Tax Credits for Low-Income Families: Starting in 2019, the plan provides tax credits for low-income families, increases the personal exemption credit, and expands the existing Earned Income Tax Credit. The plan contains approximately $7 million of new tax credits a year for low-income Nebraska families.

- Corporate Tax Relief to Create Jobs: The plan incrementally reduces the top corporate income tax rate from 7.81 percent to 5.99 percent to help make Nebraska more attractive to new companies or companies looking to expand. After an initial reduction to 7.59 percent, the plan makes continued incremental reductions only if state revenues are projected to grow by 4 percent or more starting in 2020.

For additional information about LB461 click here.

Contact Your Senator

If you want to see tax reform accomplished this year, I urge you to contact your senator immediately. There are special interests at work in the State Capitol who do not want to see any relief pass this year. Visit www.NebraskaLegislature.gov for information on how to contact your senator. If you have additional thoughts on tax reform that you’d like to share with me, please contact my office at pete.ricketts@nebraska.gov or 402-471-2244.

###